“I can calculate the motions of the heavenly bodies, but not the madness of crowds.” (Sir Isaac Newton – upon losing the equivalent of $3mm in the South Sea Bubble of 1720)

“Dogecoin can be a good barometer for how far from reality things can get.” (Billy Markus, creator of Dogecoin – he invests his money in index funds)

Being an atheist does have its drawbacks. While Richard Dawkins’ The God Delusion serves well as an antithetical holy book, when it comes to spiritual guidance the deprivation of the opioid of choice for the masses leads one to alternative and somewhat unconventional sources. In my case this oracle is frequently a certain pot smoking dude from Venice Beach, but when it comes to the curious case of Dogecoin, the wisdom of Snoopy the dog resonates. Consider this riposte to the Bhagavad Gita posed by Snoopy: “My life has no purpose, no direction, no aim, no meaning, and yet I’m happy. I can’t figure it out. What am I doing right?” In other words, there’s shit that goes down in the cosmos that makes no fucking sense whatsoever. Like Dogecoin, for example.

Over the last few months I have, albeit somewhat reluctantly, come to accept that cryptocurrencies – or more appropriately crypto assets – will occupy a permanent place in the investment universe. The notion that Bitcoin and its various offshoots displace conventional currencies continues to strike me as fanciful. Aside from the fact that the central banks of the world would never allow it, the inherent volatility and the friction associated with using crypto as a means of payment render it impractical as a currency. For example, using your Bitcoin wallet to pay for your frappuccino sounds cool – until you realize this is taxable event and start to apply FIFO accounting to your crypto acquisition(s) and disposition(s). What is more persuasive, however, is the idea of Bitcoin, with its embedded scarcity and security features, becoming an alternative to gold as an inflation hedge in an environment where Modern Monetary Theory must be treated with a healthy degree of skepticism. After all, beyond a somewhat arbitrary acceptance cemented by history, gold has no feature that renders it singularly suited to this role. Other crypto assets derive value from multiple use cases, most notably Ethereum. With its smart contract functionality, Ethereum and its progeny seem destined for a central role in the creation and trading of Non Fungible Tokens (NFTs), and the recording and processing of financial contracts generally. Short term speculative excesses – of which there are plenty in the current environment – notwithstanding, it is reasonable to posit that the powerful longer term secular trends will drive the value of crypto assets higher….maybe even to the moon…

Even NFTs, cutting through all the noise and the hype, should be recognised for what they are: clever tools, utilizing the blockchain technology that underlies all crypto assets, for solving the issues around the authentication and transferability of digital assets, and more generally empowering digital creators of all type. The fact that some dude who calls himself Metakavan decides to pay $69mm for Mike Winkelmann’s (aka Beeple) Everydays is astounding, but perhaps no more so than an anonymous collector paying $10mm for Damien Hirst’s pickled fish, or indeed Van Gogh’s failure to monetize any of his art in his lifetime. As art dealer Stefan Simchowitz says, “society gets the art that it deserves”. Incidentally, Simchowitz – clearly a dude who speaks his mind – goes on to describe the NFT oeuvre as “largely sexist, racist, immature, xenophobic, sophomoric and anti-art.” Monty Python would agree. In a delightful expression of quintessentially British irony, John Cleese decided to auction – as an NFT – a rudimentary sketch of the Brooklyn Bridge by An Unnamed Artist Named John Cleese, while observing that “the world has gone terminally insane”. Appropriately, the auction terminated on April Fools’ Day. To which Beeple and Metakavan might legitimately respond “yeah, well, that’s just, like, your opinion, man”.

All of which is a longwinded way of saying one can actually rationalise much of what is happening in the world of crypto – except for the bizarre saga of Dogecoin. While there have been multiple cases of absurdly overvalued assets in the history of markets, Dogecoin is unique inasmuch as it was intentionally designed to be worthless. Unlike stocks, there is no residual claim on the cashflows and assets of a business, and unlike bonds, there is no contractual right to demand repayment. Unlike Bitcoin, there is no intrinsic mechanism to preserve scarcity, and unlike Ethereum, this is no current or future commercial application or use case. Unlike tokenized native digital art, Dogecoin has no pretensions to be a collectible; by design Dogecoin is fungible rather than non-fungible i.e. every Dogecoin is the same. And of course, unlike tangible assets like real estate or fine wine, Dogecoin has no intrinsic worth. Even its name seems like a screw-up – why not Doggy-coin, evocative of cute puppies, rather than Dohj-coin, which conjures up images of Venetian nobility with funny hats? It’s creators are repeatedly on record as saying they intended Dogecoin to be a joke. Like Snoopy’s life, therefore, Dogecoin has no purpose, no direction, no aim and no meaning. And still it’s worth a mind bending $50bn. About the same as Ford Motor – though Lehman Brothers, valued at circa $60bn at its peak, might be a more appropriate comparison.

And just when you think it couldn’t get any sillier, Dogecoin fans proclaimed April 20, apparently celebrated annually as Weed Day, as Doge Day. Presumably the time to take Dogecoin higher? I suppose every dog(e) has its day, so why not? They failed, rather like Al Pacino’s bungled caper in Dog(e) Day Afternoon, but regardless their commitment remains unwavering. You could not make this shit up.

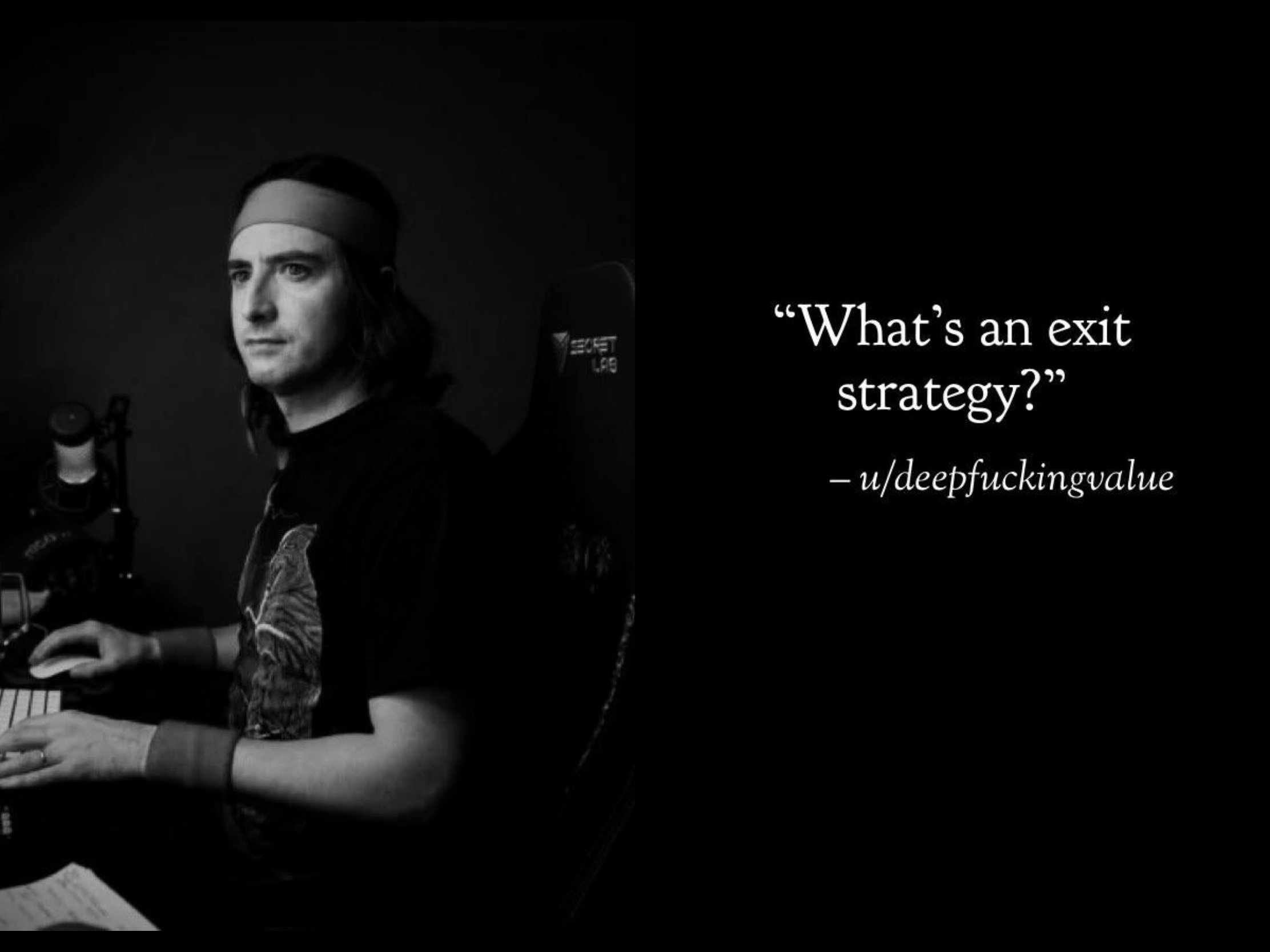

In case you’re wondering, I have no explanation other than the somewhat trite observation that we seem to be in midst of the mother of all speculative bubbles, with Dogecoin surpassing Gamestop as a metaphor for a world gone barking mad. Indeed, it is a case of more new shit coming to light, in this case a Dogeshit canine mutation. In an environment where gambling is tightly regulated and access to relatively safe investments restricted to investors who satisfy suitability tests, it blows my mind that the powers that be allow leveraged bets on worthless “assets”, not to mention the mailing of checks that are frequently directed to rampant speculation rather than directed consumption. Or the shocking irresponsibility of the redoubtable Elon Musk, with his cult following among the Reddit crowd, and his incessant Tweets promoting Dogecoin, ostensibly as a joke. The latest from the self proclaimed Dogefather – doing it dogey style on Saturday Night Live. Like I said, you could not make this shit up…

All I can say with certainty is that, as is the case with all bubbles, this too shall burst. Even a genius like Newton was taught a painful lesson in the laws of gravity as applied to speculative assets. And when the other shoe drops, there will be books written about it – perhaps even by yours truly. As for the title, it’s obvious of course. Who Let The Doges Out.